#53: Visa's Trusted Agent Protocol, Notorious Scam Empire Takedown, Europol Bust

This week’s stories highlight how critical it is to build detection strategies that go beyond isolated signals. Whether you’re defending against AI agents gone rogue or phony vendors exploiting back-office gaps, the future of fraud prevention lies in linking patterns, behavior, and infrastructure before your customers are caught in the crossfire.

Let’s get into it.

NATE'S TAKE - OCTOBER 21, 2025

Top Three This Week

- Visa, Cloudflare, and Coinbase Want to Make AI Shopping Safer

- US and UK Sanction Southeast Asia’s Most Notorious Scam Empire

- Europol Busts Massive SIM-Box Fraud Infrastructure

1. Visa, Cloudflare, and Coinbase Want to Make AI Shopping Safer

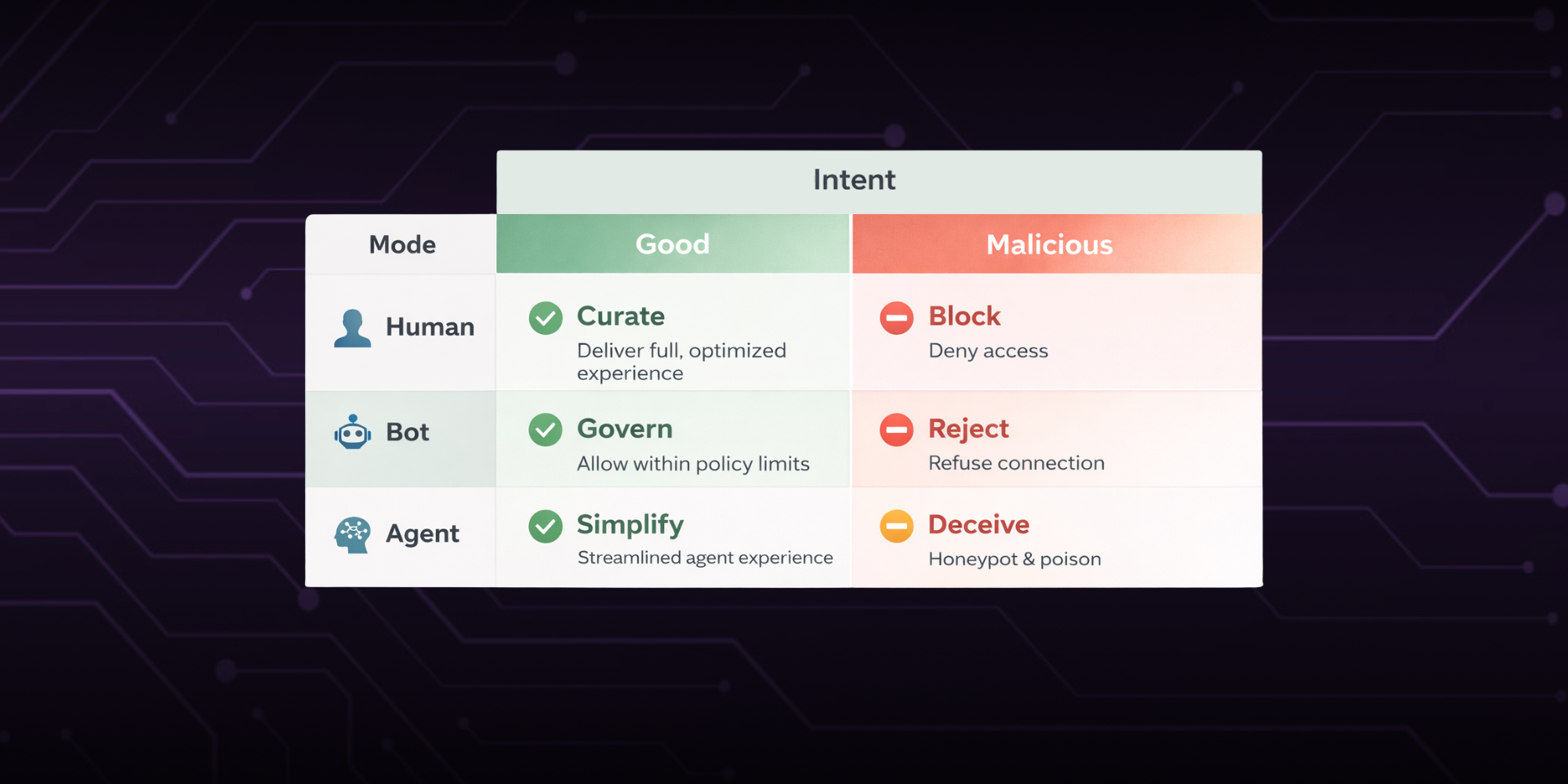

Agentic commerce – where AI agents transact on behalf of consumers – is no longer speculative. It's here, and Visa wants a front-row seat. Last week, the company launched its Trusted Agent Protocol, a cryptographic standard that allows merchants to differentiate between legitimate AI shoppers and malicious bots. The protocol aims to make AI-initiated payments just as seamless and secure as human ones, without requiring merchants to overhaul backend systems.

Visa’s protocol uses cryptographic signatures to identify and authenticate trusted AI agents. That means if you’re building or defending a platform that supports AI-initiated shopping, you’ll want to understand which agents are trusted, how they’re verified, and how the signal will flow to your systems. Visa is collaborating with global standards bodies and partners like Google, Stripe, Coinbase, OpenAI, and Cloudflare to ensure interoperability.

While the long-term future of agentic commerce is still forming, Visa’s early move to establish trust standards suggests security signals will shift toward agent reputation and proof-of-intent, not just IPs and user fingerprints. As the fraud stack adjusts to meet this new AI-native commerce layer, defenders will need to decide where and how to consume this signal to reduce false positives and stop bad agents before they blend in.

RELATED: Agentic AI & The Bot Problem You Can’t See

2. US and UK Sanction Southeast Asia’s Most Notorious Scam Empire

The U.S. and U.K. just launched the largest coordinated enforcement action to date against transnational scam operations, targeting Cambodia-based Prince Group and its founder, Chen Zhi. The group is accused of running forced labor scam compounds that have defrauded victims around the world out of billions of dollars.

Authorities say the network lured people with fake job ads and forced them to carry out scams, including romance and investment fraud, under threat of violence. The U.S. DOJ has charged Chen with conspiracy to commit wire fraud and money laundering, while the FBI seized $15 billion in bitcoin and froze several UK properties, including a £12M mansion and £95M office building in London.

Despite the scale of this takedown, the scam ecosystem remains deeply entrenched across Southeast Asia, where an estimated hundreds of thousands of people are being held and coerced into carrying out fraud.

For global fraud teams, if a scam looks unusually well-resourced or coordinated, it might be backed by a full-blown criminal enterprise. The level of financial sophistication and geographic sprawl means attribution alone is often not enough. Organizations must build processes that detect and disrupt behavior, not just identities.

3. Europol Busts Massive SIM-Box Fraud Infrastructure

In a Europol-led operation dubbed SIMCARTEL, law enforcement arrested seven suspects, dismantled a vast cybercrime-as-a-service infrastructure, and seized 1,200 SIM boxes and over 40,000 active SIM cards. These devices were used to help criminals create fake online identities, spoof phone numbers, and enable phishing, smishing, and account fraud across Europe.

The seized infrastructure supported over 49 million online accounts, many of which were created for fraud, marketplace scams, fake banking sites, and impersonation attacks like the "daughter–son scam" and bogus police calls. One of the most sophisticated features of this service: phone numbers registered to individuals in over 80 countries were being rented out to obfuscate identity and bypass platform verification systems.

This takedown underscores how central telecom identity abuse has become to the fraud economy. If your fraud detection stack still treats SIM card verification or device fingerprinting as high-trust signals without cross-checking behavior or history, this is your cue to rethink. Massive phone identity infrastructure like this doesn't just support phishing, it fuels the synthetic identities and behavioral mirroring that make modern fraud campaigns scalable.

===

That’s all for this week! For more insights, follow us on LinkedIn or X, and if you want to learn more about what we do, visit www.specprotected.com.

Ready to get started with Spec?

Nate Kharrl, CEO and co-founder at Spec, has built leading solutions for application security and fraud challenges since the early days of the cloud era. Drawing from his cyber experience at Akamai, ThreatMetrix, and eBay, Nate helped found Spec to focus on the needs of businesses operating in a landscape of increasing AI risks. Under Nate’s leadership, Spec grew from its mid-pandemic founding to raise $30M in venture-backed funding to build solutions used by Fortune 500 companies transacting billions in online commerce. Spec’s service offerings today include protective measures for websites and APIs that specialize in defending against attacks designed to bypass bot defenses and risk assessment platforms.