Why I Believe in Spec: A Fraud Fighter’s Perspective

After nearly a decade in the fraud prevention trenches, working across fintech and online marketplaces, evaluating countless vendors, and collaborating within the fraud-fighting community, I thought I had seen it all.

Then I joined Spec.

And everything I thought I knew about what was possible, but had hoped for, was changed.

A Game-Changer in Fraud Prevention

Throughout my career, I have evaluated many solutions claiming to revolutionize fraud detection and prevention. Rarely did they live up to the hype. At best, they were incremental improvements over traditional rule engines or machine learning models, constrained by stale data, slow adaptability, API calls and configurations, and rigid deployment limitations.

Spec is different.

I’ve seen Spec reduce fraud rates by over 90% across clients and use-cases, consistently, and sometimes even higher. For one client, we eliminated over 98% of their payment fraud. Not just shifted it. Not just reduced it temporarily. Eliminated it.

Fraudsters who previously targeted our clients with sophisticated, large-scale attacks were left scrambling, confused, isolated, and ultimately giving up. In many cases, attacks didn’t simply adapt or move elsewhere; they vanished entirely.

Why Spec Works So Well

Spec’s effectiveness isn’t magic. It's rooted in technology, data, and adaptability at a level that traditional solutions cannot match:

- Complete Session Visibility: From the moment a user touches a client’s platform to the second their session closes, we capture and contextualize everything, not just transactions or login events, but the entire behavioral journey.

- Proprietary Spec ID & Advanced Fingerprinting: Even when standard identifiers are missing, we link sessions with stunning accuracy. Spec can create custom fingerprints using non-traditional data fields, sometimes even fragments of fields, to detect and connect malicious behaviors that others would miss.

- Micro-Level Targeting: We don't settle for simplistic pattern-matching. We break down fields to granular elements, building behavioral models and fraud detection logic that operate at an atomic level.

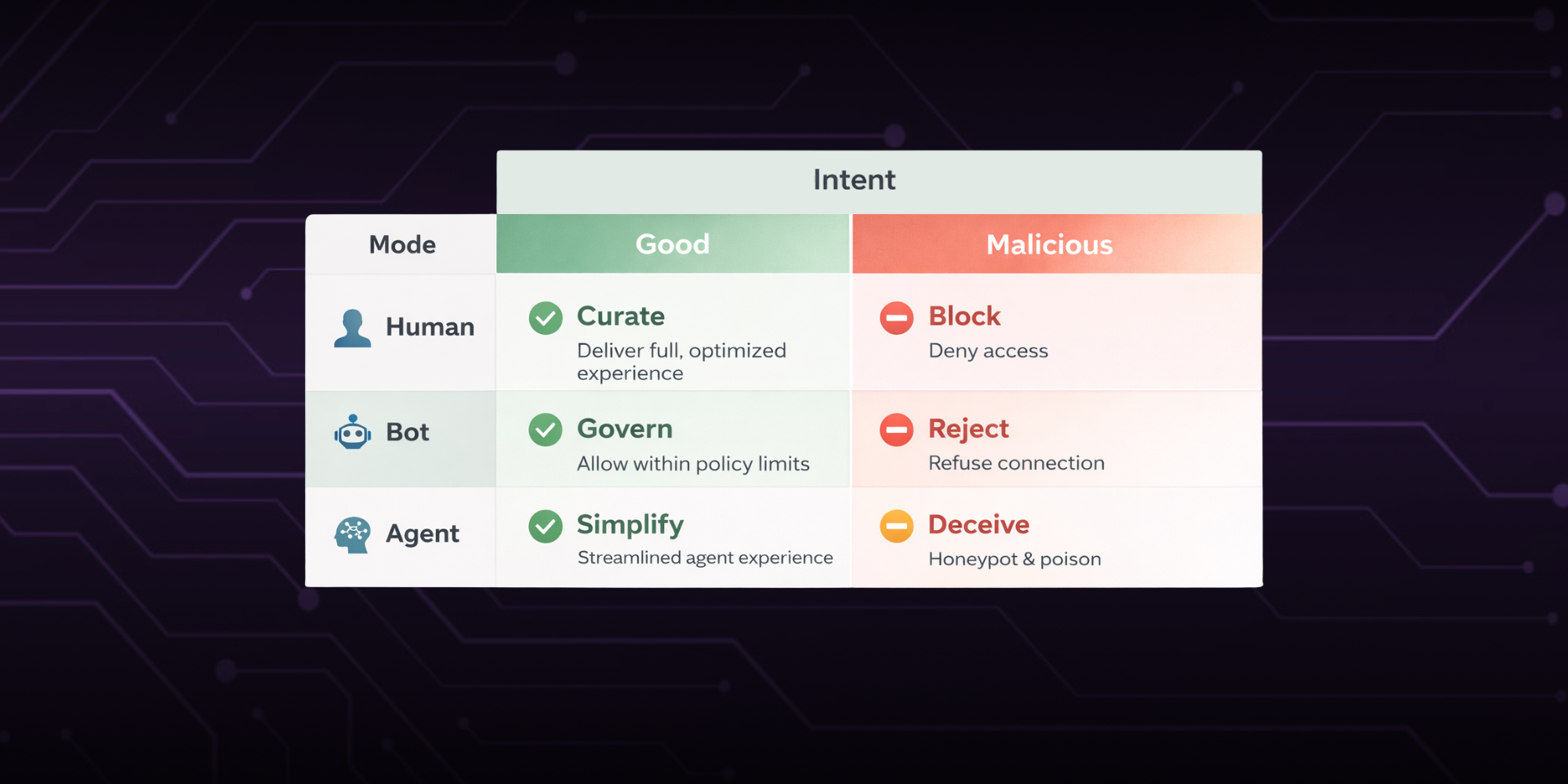

- Honeypots and Deception Tactics: Beyond blocking bad actors, we trap, deceive, and mislead them, feeding back false signals that leave them guessing and cripple their ability to adapt.

- Speed and Precision: We don't just react. Spec can proactively dismantle fraud rings before they even understand what’s happening. The results? Sessions dry up. Fraud rings disband. Attackers walk away defeated.

Breaking Through Skepticism

When we talk to prospective clients, we hear it all the time:

"It sounds too good to be true."

I get it — I was skeptical at first, too. The numbers were hard to believe until I saw it firsthand. Watching fraud event volumes collapse from hundreds of thousands per day to almost none, and seeing those results sustained across industries and use cases, is something you don’t forget.

Every challenge clients throw at us, we meet. Every new use case, we adapt. Every fraudster tactic, we counter, faster and smarter than they can adjust.

And when a roadblock appears? We innovate. At Spec, roadblocks aren't where things stop, they’re where new capabilities are born.

Endless Possibilities

Working at Spec has been a personal and professional breakthrough for me. For the first time, I feel like I have everything I’ve ever wished for in a fraud prevention platform; data access, analytical depth, flexible deployment, and the ability to constantly evolve.

There’s almost no limit to what Spec can detect, defend, and deploy. And if a limit ever appears, it becomes our next opportunity for innovation.

Fraud doesn’t stand still. Neither does Spec.

If you're tired of fighting a losing battle… If you’re ready to see just how much better things can be… Account takeovers, payment fraud, bots, any type of policy abuse… If it is fraud and you need help, come talk to us.

https://www.specprotected.com/contact

And keep an eye on our website, our LinkedIn, and my personal LinkedIn for an upcoming blog series where I’ll dive deeper into what makes Spec truly unique, connecting our unique capabilities to real-world fraud use cases. I want to help you understand what makes Spec different and why we are the right fraud solution to help you protect your stakeholders, platforms and bottom-line.

Ready to get started with Spec?

As a seasoned fraud management professional with nearly 6 years of experience and CPFPP certification, Shawn specializes in developing and executing comprehensive fraud strategies that protect businesses from financial and reputational losses due to fraud. His background includes leading fraud investigations, building in-house fraud solutions, and enhancing fraud analytics capabilities at companies like Neo Financial and JustEatTakeaway.com. Shawn thrives in high-pressure environments where swift and accurate decision-making is critical. His passion for fighting fraud extends beyond the workplace and he is deeply committed to the fraud-fighting community.